- California tax brackets 2021 pro#

- California tax brackets 2021 software#

- California tax brackets 2021 free#

California tax brackets 2021 software#

Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Online AL, DC and TN do not support nonresident forms for state e-file.

Most state programs are available in January. State e-file available within the program.Description of benefits and details at /guarantees.

California tax brackets 2021 free#

Receive 20% off next year’s tax preparation if we fail to provide any of the 4 benefits included in our “No Surprise Guarantee” (Upfront Transparent Pricing, Transparent Process, Free Audit Assistance, and Free Midyear Tax Check-In). Audit Defense only available in TurboTax Max bundle. The audit risk assessment is not a guarantee you will not be audited. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. H&R Block Audit Representation constitutes tax advice only. TurboTax® offers limited Audit Support services at no additional charge. Prices based on, and (as of 11/28/17). Windows® is a registered trademark of Microsoft Corporation. TaxAct® is a registered trademark of TaxAct, Inc. TurboTax® and Quicken® are registered trademarks of Intuit, Inc. H&R Block is a registered trademark of HRB Innovations, Inc. Terms and conditions apply see Accurate Calculations Guarantee for details. If the online tax preparation or tax software makes an arithmetic error that results in your payment of a penalty and/or interest to the IRS that you would otherwise not have been required to pay, H&R Block will reimburse you up to a maximum of $10,000. To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in tax laws after January 1, 2022. If you discover an error in the H&R Block tax preparation software that entitles you to a larger refund (or smaller liability), we will refund the software fees you paid to prepare that return and you may use our software to amend your return at no additional charge. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits.  Emerald Cash Rewards™ are credited on a monthly basis. All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Additional terms and restrictions apply See Free In-person Audit Support for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state). Prefer a different way to file? No problem – you can find California state tax expertise with all of our ways to file taxes. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CA taxes, including federal deductions for paying state taxes.

Emerald Cash Rewards™ are credited on a monthly basis. All prices are subject to change without notice. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. Additional terms and restrictions apply See Free In-person Audit Support for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state). Prefer a different way to file? No problem – you can find California state tax expertise with all of our ways to file taxes. Then, you will upload your tax documents, and our tax pros will do the rest! We can help with your CA taxes, including federal deductions for paying state taxes. California tax brackets 2021 pro#

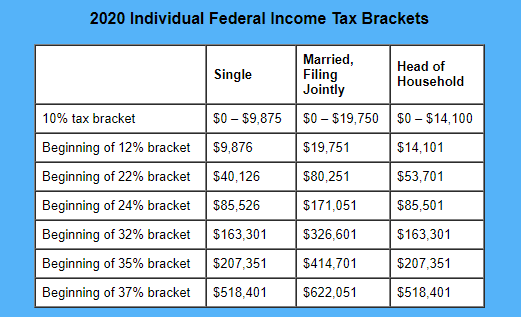

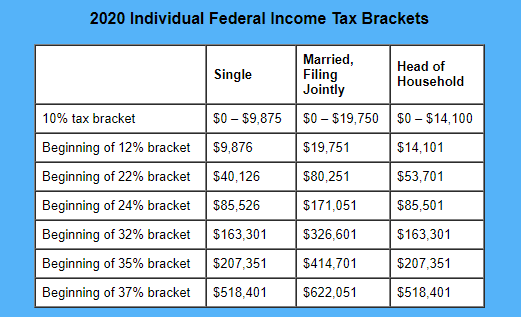

Luckily, we’re here to save the day with H&R Block Virtual! With this service, we’ll match you with a tax pro with California tax expertise. Understanding California income tax rates can be tricky. Help With California Income Tax Rates & More California Tax Brackets for Single Taxpayers Taxable IncomeĬalifornia Tax Brackets for Married/Registered Domestic Partner (RDP) Filing Jointly Taxpayers (and Qualifying Widowers) Taxable IncomeĬalifornia Tax Brackets for Married/Registered Domestic Partner (RDP) Filing Separately Taxpayers Taxable IncomeĬalifornia Tax Brackets for Head of Household-Filing Taxpayers Taxable Income See the tables below to view what your California tax rate may be, based on your filing status. The California income tax brackets are based on taxable income as well as your filing status. How Are California Income Tax Brackets Determined? There are nine California tax rates, and they are based on a taxpayer’s adjusted gross income.

California income taxes are drawn from your paycheck as a percentage of money that you pay to the state government based on the income you earn. State tax is levied by California on your income each year. Some states have a flat tax rate, marginal tax rate, or don’t have any state taxes at all. While federal tax rates apply to every taxpayer, state income taxes vary by state.

0 kommentar(er)

0 kommentar(er)